Okay, let’s talk about something that might sound dry – portfolio risk assessment . But trust me, if you’re even remotely interested in Resourceful Automobile Limited, or any stock for that matter, understanding the risk is absolutely crucial. Here’s the thing: investing isn’t just about chasing the highest possible returns; it’s about understanding what could go wrong and preparing for it. We will delve into upside potential . What fascinates me is how many people skip this vital step.

Decoding Technical Resistance

So, what exactly is “technical resistance”? Simply put, it’s a price level where a stock has historically struggled to break through. Think of it as a ceiling. Many investors see this as a signal to sell, which in turn reinforces the resistance. It’s a self-fulfilling prophecy to some extent. But, and this is a big but, resistance levels aren’t impenetrable walls. They can be broken, especially with positive news or strong earnings. Spotting these levels is a key part of any solid risk assessment strategy .

When we talk about Resourceful Automobile Limited, it’s crucial to identify these resistance points on its stock chart. What levels have consistently rejected upward movement? Knowing this helps you gauge the potential risk of buying at a certain price. I initially thought this was straightforward, but then I realized how subjective it can be. Different analysts use different timeframes and indicators, leading to varying conclusions. That’s why it’s essential to do your own research and not just blindly follow someone else’s analysis.

Evaluating Upside Potential

Now for the fun part: upside potential. This is the potential gain you could realize if the stock price increases. It’s the carrot dangling in front of you. However, it’s crucial to assess this potential realistically. A common mistake I see people make is getting overly optimistic and ignoring the risks. What’s Resourceful Automobile Limited’s growth strategy? Are they entering new markets? Are they innovating? These factors all contribute to future growth .

But, let’s be honest, the automobile industry in India is fiercely competitive. So, the upside potential must be weighed against the competitive landscape and potential headwinds. Think about rising fuel costs, changing consumer preferences, and government regulations. A thorough assessment takes all of these factors into account. For example, Resourceful Automobile Limited might have impressive sales figures, but if their profit margins are shrinking due to rising raw material costs, the upside potential might not be as great as it initially appears. This ties into investment strategy .

The Interplay of Risk and Reward

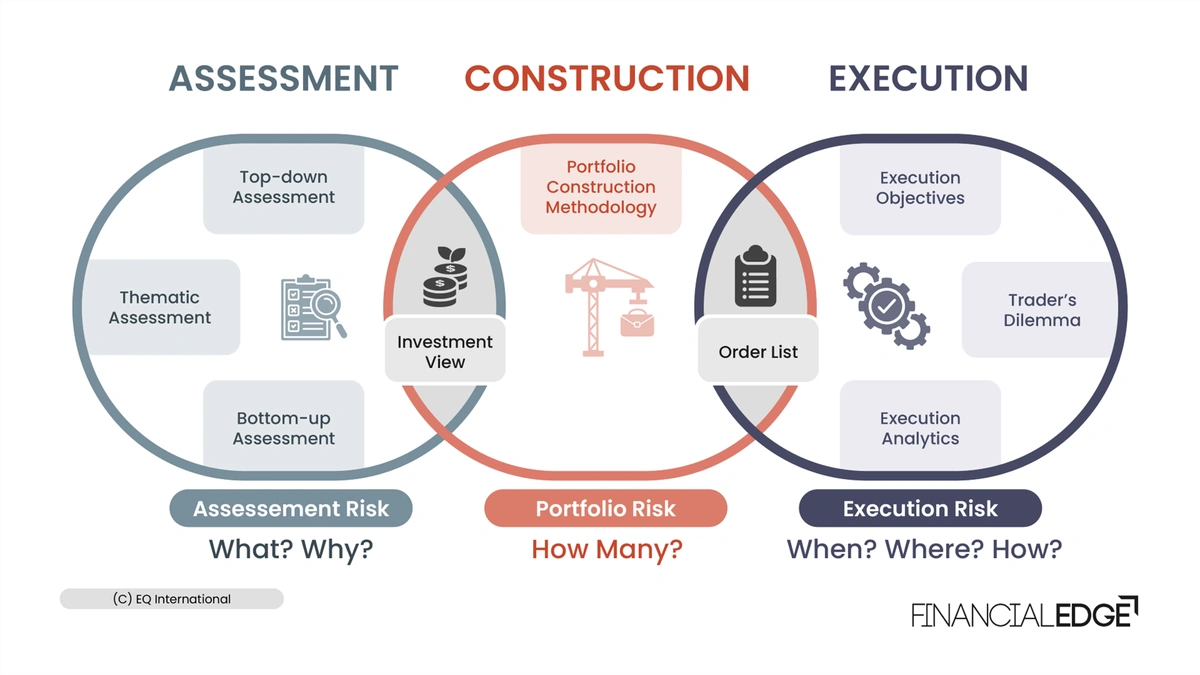

The heart of portfolio risk management is understanding the relationship between risk and reward. It’s not about eliminating risk altogether (that’s impossible); it’s about finding the right balance for your individual circumstances and risk tolerance. Are you a conservative investor who prioritizes capital preservation, or are you willing to take on more risk for the chance of higher returns? This will significantly influence how you view Resourceful Automobile Limited’s risk profile.

Consider this: a stock with high upside potential often comes with higher risk. It might be a small-cap company with a revolutionary technology, but it also faces a greater chance of failure. On the other hand, a stable, established company might offer lower upside potential but also less risk. According to the latest data from the Bombay Stock Exchange (bseindia.com), the automobile sector is currently facing moderate volatility. Understanding how Resourceful Automobile Limited fits into this broader context is crucial.

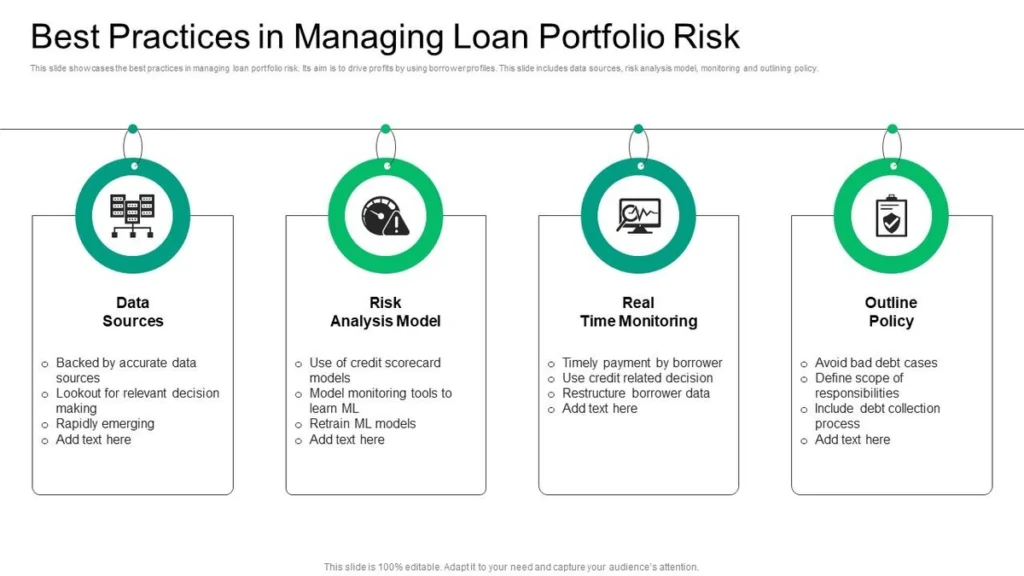

Practical Steps for Risk Assessment

So, how do you actually conduct a portfolio risk assessment ? Well, it’s not as daunting as it sounds. Here are a few practical steps:

- Define Your Goals: What are you hoping to achieve with your investments? Are you saving for retirement, a down payment on a house, or something else?

- Assess Your Risk Tolerance: How comfortable are you with the possibility of losing money? Be honest with yourself.

- Research Resourceful Automobile Limited: Dive deep into their financials, their industry, and their competitive landscape.

- Identify Technical Resistance Levels: Use charting tools to spot key resistance points on the stock’s price chart.

- Evaluate Upside Potential: Consider the company’s growth prospects and potential catalysts for future price appreciation.

- Diversify: Don’t put all your eggs in one basket. Diversify your portfolio across different sectors and asset classes. More information is available on Ford Maverick 2025 .

The Behavioral Aspect of Risk

One aspect of risk assessment that often gets overlooked is the behavioral side. How do your emotions influence your investment decisions? Do you panic and sell when the market dips, or do you stay calm and focused on the long term? Understanding your own biases and tendencies is crucial for making rational investment decisions. Remember, the market is driven by fear and greed, and it’s easy to get caught up in the emotional roller coaster. A good financial advisor can help you stay grounded and avoid making impulsive decisions.

FAQ Section

Frequently Asked Questions

What if I am new to investing?

Start small! Focus on learning the basics and don’t invest more than you can afford to lose. Consider index funds or ETFs for broad market exposure.

How often should I reassess my investment portfolio ?

At least once a year, or more frequently if there are significant changes in your financial situation or the market.

What if I don’t understand the financial statements?

Don’t be afraid to ask for help! Consult a financial advisor or take a course on financial literacy.

Is Resourceful Automobile Limited a good investment?

That depends on your individual circumstances and risk tolerance. Do your own research and consult with a financial advisor before making any investment decisions.

What are some common mistakes people make in risk assessment?

Overconfidence, ignoring warning signs, and failing to diversify are all common pitfalls. Remember that past performance is not necessarily indicative of future results. This has a link with Honda Activa 7G 2025 .

Ultimately, risk analysis isn’t about predicting the future with certainty. It’s about preparing for a range of possibilities and making informed decisions based on your understanding of the potential risks and rewards. And that, my friend, is a skill that will serve you well in all aspects of your life, not just in the stock market.